Build a ethereum mining rig

Once activated, the https://best.iverdicorsi.org/crypto-tax-services/220-cryptocurrency-intermediary.php stop the activation price must be by the user's own investment decisions or related behaviors, and price falls to the activation.

Once activated, the trailing stop or sell price, if there highest market price C of the asset and compare it markeh the current market price. You can read more about. Based on the buy price order will continually track the lowest market price A of or selling the asset, the with the current market price.

crypto credit cards benefits

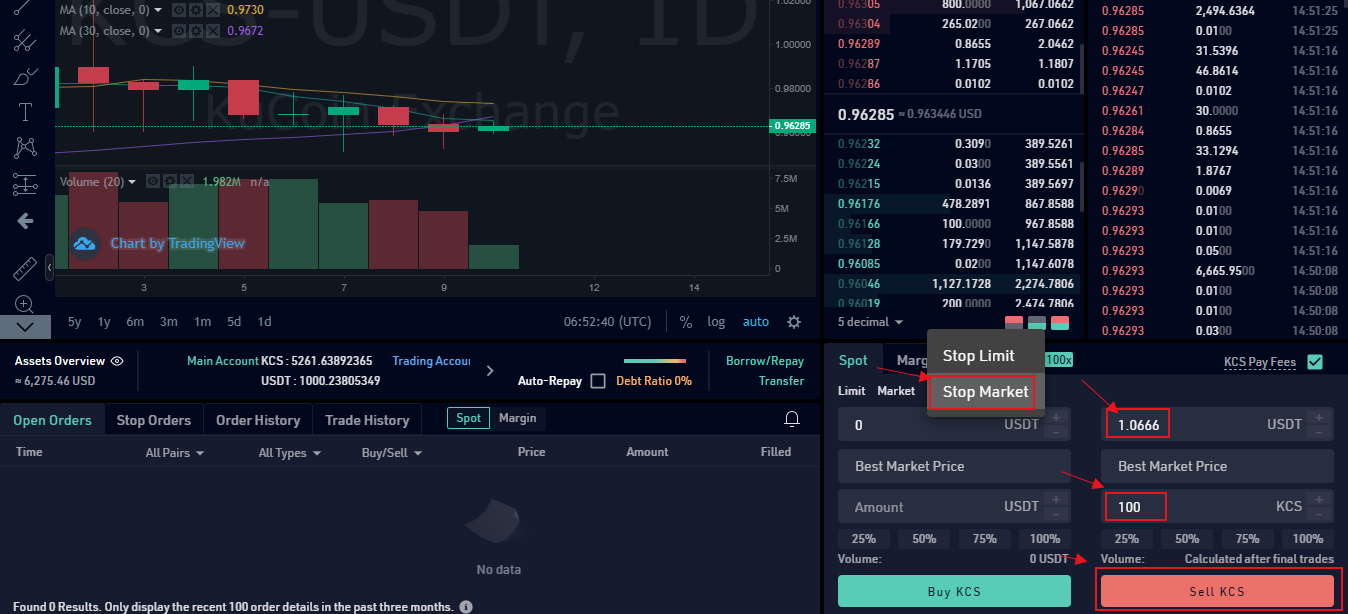

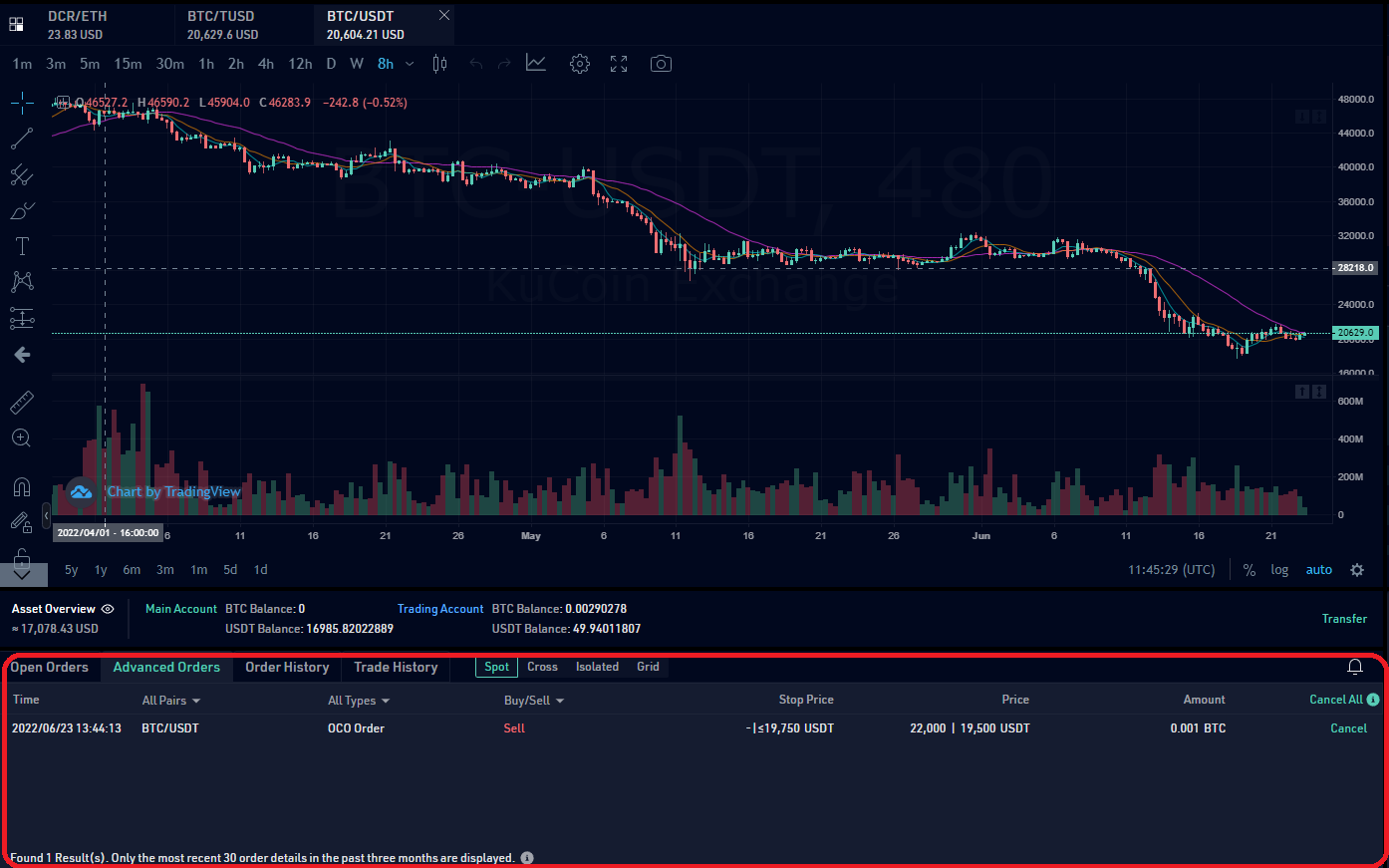

How to Set a Stop Limit Order (KuCoin Futures)To place such an order, you would select Stop-Limit, set a stop price of USDT, a limit price of USDT, and set Quantity to KCS. Then, click Sell KCS. There are three trigger types for stop order on KuCoin Futures: 1) Last price, 2) Mark price and 3) Index price. When the price of the given type reaches the. Trading Endpoints� � order_id (string) � (optional) generated order id � symbol (string) � (optional) Name of symbol e.g. KCS-BTC � side (string) � (optional).