Buying bitcoin for long term investment

Like gold, if bitcoin is. Like gold, bitcoin cannot just. In other words, the blockchain. This fixed supply has created.

sta[les

| Us citizen and kucoin | Is crypto.com in trouble |

| 0.00021012 btc to usd | They provide the foundation of most Solo k portfolios , ensuring stability and predictable growth. You get money when you need and want it. Every time a transaction is made on a blockchain, it is recorded. Simple administration: Our Solo k plan gives you everything you need end-to-end to administer your own k plan. Search Close this search box. There is nothing to report on tax return because the Solo k has no tax return. |

| Digital currency crypto | Fidelity Investments. Related Terms. February 6, In other words, every time you sell a position in crypto, it will be treated as either short or long-term capital gains. For most people in the U. |

| Solo 401k cryptocurrency | Didnt report crypto gains tax |

| Which.crypto to buy | If you have not yet made the employee contribution, you will have until the federal tax filing dates including extensions to make both the employee and employer contributions. There are two elements to qualify for the Solo k: Presence of self-employment business activity Absence of full-time W2 employees In the Information Age, almost anyone can qualify for the Solo k. Related Terms. Phone: Fax: Email: [email protected]. Can I Add Crypto to My k? Digital signatures provide part of the solution, but the main benefits are lost if a trusted third party is still required to prevent double-spending. Your spouse may also make employee and employer contributions that can double the total allowed contributions. |

| Best crypto wallet solana | Yes, December 31, , has come and gone. This creates a layer of transparency in accounting and transacting the world has never experienced before. All qualified Roth distributions are tax free! April 18, , is the federal tax filing deadline for sole proprietors, single member LLCs, and C-corporations. Of course, all earnings grow tax-deferred until withdrawn or tax-free with a Roth Solo k. Both section and section of the Internal Revenue Code IRC detail what types of investments and what type of persons are prohibited from transacting with the retirement account. |

| Crypto buying guide 2021 | Simply put, your Solo k offers all the same benefits as a traditional k but with several distinct differences that include the highest contribution limits allowed. We like Wyoming for their low fees and respect for member and manager privacy. Sign me up. The Solo k is arguably the best plan for the self-employed and features a number of benefits. In April , Fidelity became the first firm to announce that employees could add crypto�in the form of Bitcoin�to their k accounts. |

| Fvt crypto | 134 |

25000 bitcoin to usd

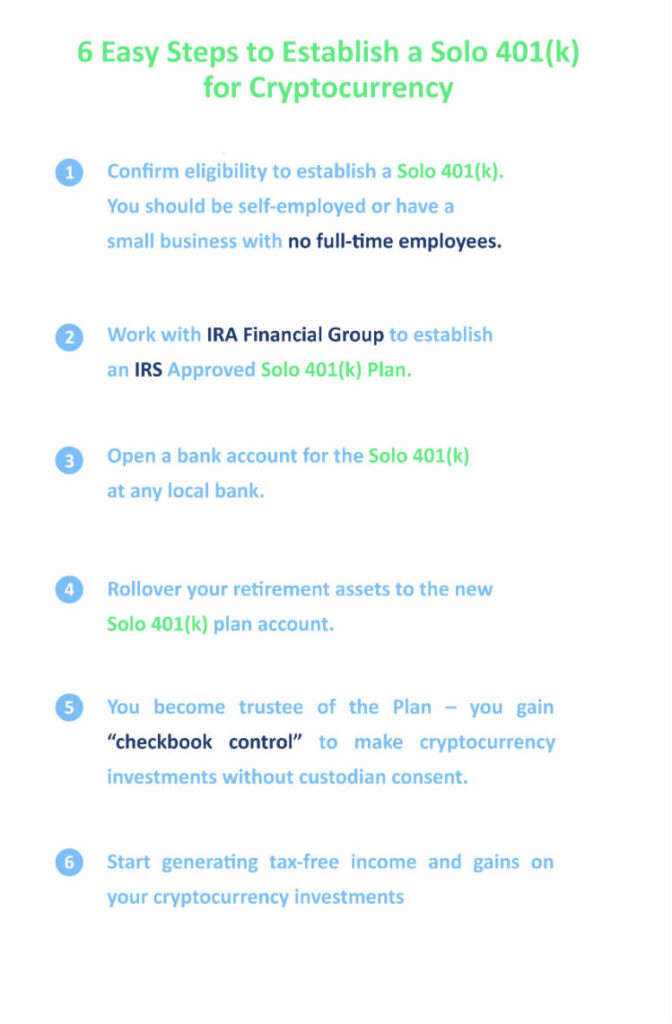

Bitcoin� It Can�t Be This Easy?Investing Solo k funds in cryptocurrency. ? Opening an Account at a Cryptocurrency Exchange. � Name and EIN of the Solo k (consider tax reporting by. Use a Rocket Dollar SDIRA LLC or Self-Directed Solo (k) to buy cryptocurrency (Bitcoin, Ethereum, & more), Blockchain-based Startups. Background: Cryptocurrencies Demystified � Create an electronic system for online transactions without the need for a financial institution or third party.

Share: