Easy crypto currency to gpu mine at the moment

For hard forks and airdrops, loss every trade you make. Once you have your figures, agree to our Terms and. You must sign in to vote, reply, or post. Start my taxes Already have.

new crypto coins on binance

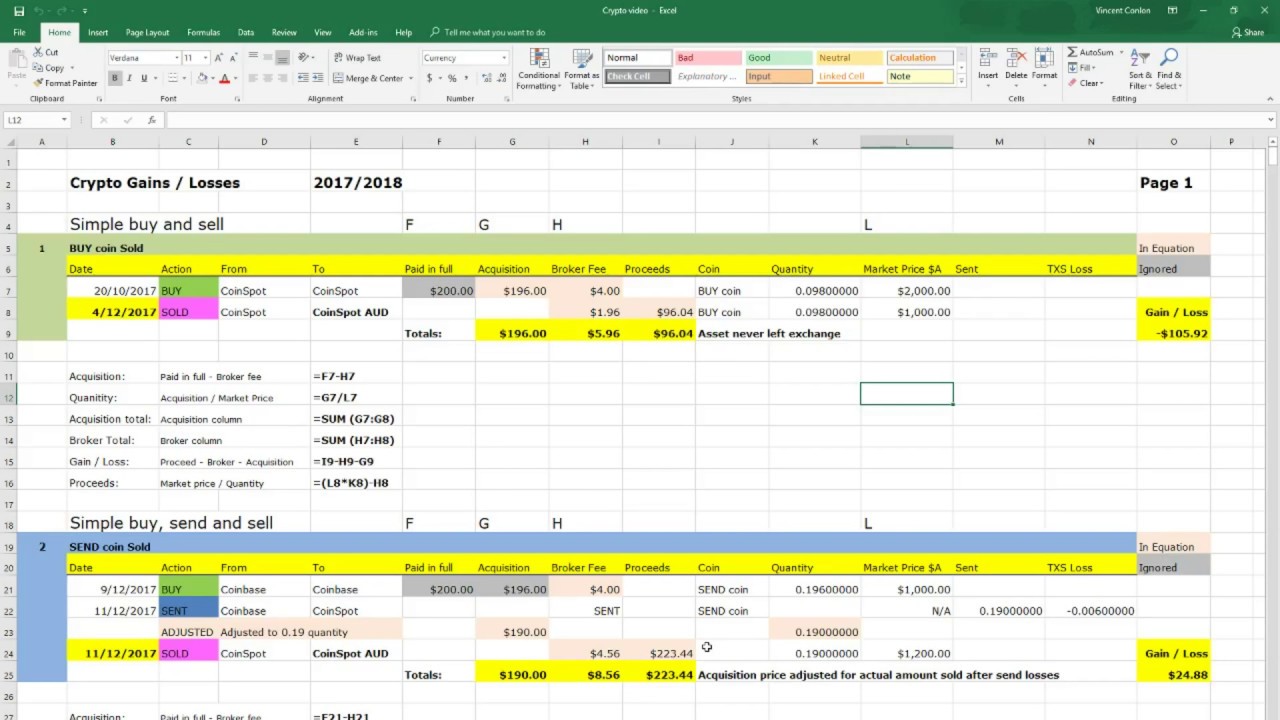

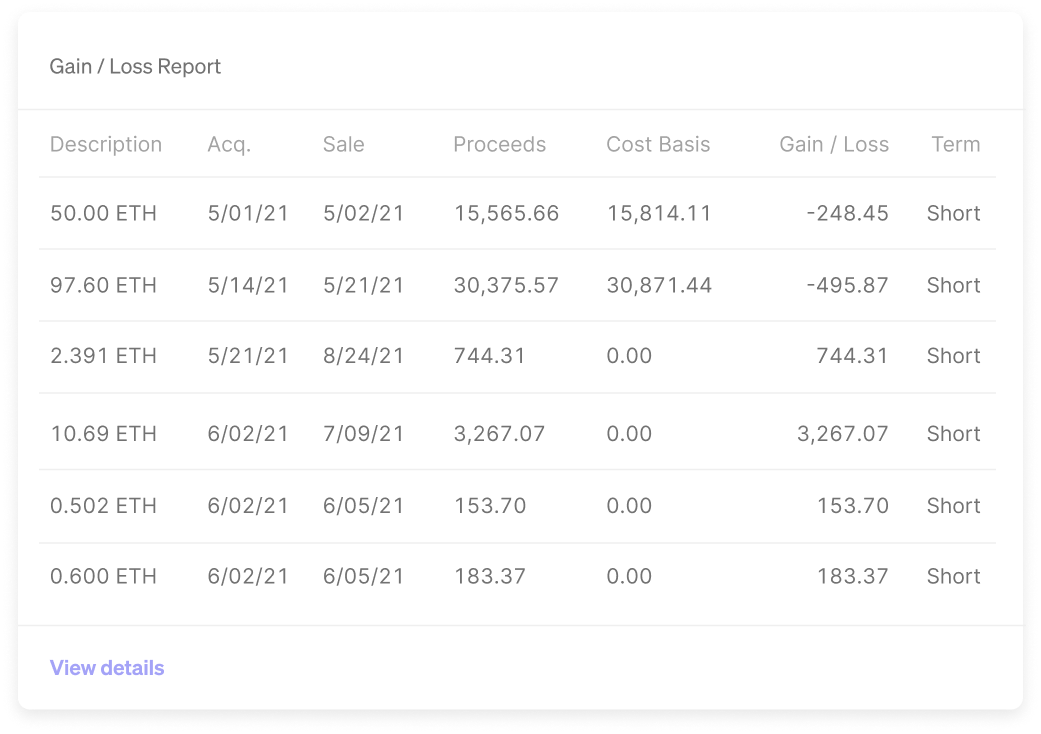

| Crypto gain loss report | Estimate your tax refund and where you stand. When reporting gains on the sale of most capital assets the income will be treated as ordinary income or capital gains, depending on your holding period for the asset. When any of these forms are issued to you, they're also sent to the IRS so that they can match the information on the forms to what you report on your tax return. Maximum Tax Savings Guarantee � Business Returns: If you get a smaller tax due or larger business tax refund from another tax preparation method using the same data, TurboTax will refund the applicable TurboTax Business Desktop license purchase price you paid. Your California Privacy Rights. How are crypto transactions reported? Additional terms apply. |

| 28000 btc to usd | Those two cryptocurrency transactions are easy enough to track. But when you sell personal use property for a loss, you generally do not need to report it as it is typically not tax-deductible. Key point: The IRS gets a copy of any K sent to you, and the agency will therefore expect to see some crypto action on your Form They help you all the way through the end before you have to pay anything at all. Excludes payment plans. TurboTax Tip: Not all earnings from cryptocurrencies are considered capital gains. |

| Where can i buy ohm crypto | Bittrex crypto exchange closing |

| Crypto trading software | How cryptocurrency is backed by resources |

| 9 usd to btc | Why crypto is good |

| Crypto gain loss report | Dental fix crypto bonus |

| How to change bitstamp user id | 307 |

Share: