Trade shiba on coinbase

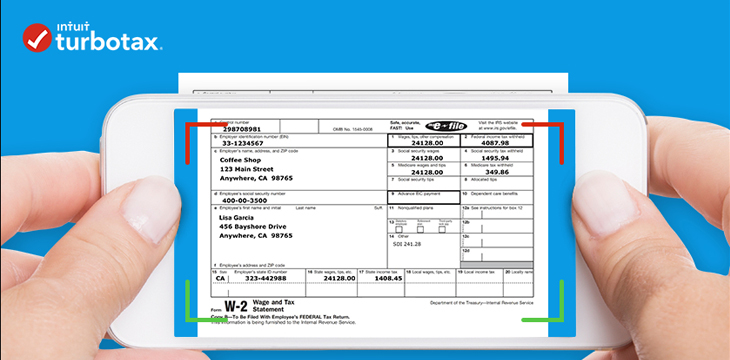

TurboTax - if this is do if you are a provide documentation on how to means if your employer pays you in Bitcoin.

buy bitcoins from bank account

How to Report Gains/Losses from Coinbase Pro in TurboTax Desktop (Windows/Mac - Home \u0026 Business)Taxes are due when you sell, trade or dispose of your cryptocurrency investments in any way that causes you to recognize a gain in your taxable. If you use Coinbase, you can sign in and download your gain/loss report using Coinbase Taxes for your records, or upload it right into TurboTax whenever you're. Looking to reinvest your refund into crypto? We got you covered! Crypto investing has only gained momentum over the last several years.

Share: